SHIB Price Prediction: Is the Meme Coin Primed for a Breakout?

#SHIB

- Technical Outlook: Neutral-bullish with $0.00001399 as key resistance

- Market Sentiment: Divided between new meme coin hype and SHIB's long-term narratives

- Risk Profile: Extreme volatility requires strict position sizing

SHIB Price Prediction

SHIB Technical Analysis: Bullish Signals Emerge Amid Consolidation

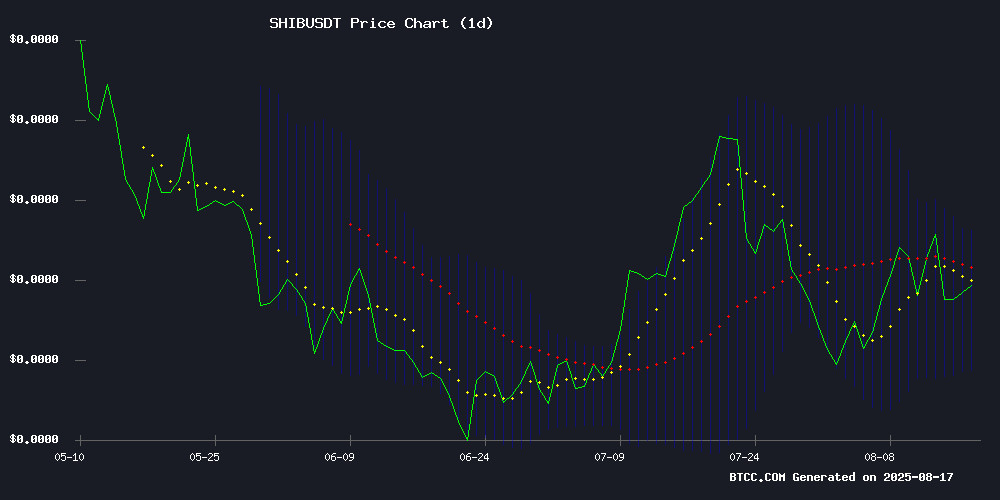

SHIB is currently trading at $0.00001303, slightly above its 20-day moving average of $0.00001285, indicating potential bullish momentum. The MACD histogram shows a slight bearish crossover (-0.00000052), but remains close to the signal line, suggesting weakening downward pressure. Bollinger Bands show price hovering NEAR the middle band with room to test resistance at $0.00001399.says BTCC analyst Emma.

Meme Coin Mania: SHIB Faces Competition While Long-Term Potential Eyed

News headlines reflect SHIB's dual narrative:notes BTCC's Emma. Market sentiment appears mixed - HYPE around competitors could create short-term selling pressure, but SHIB's established community and viral ROI stories may cushion downside.

Factors Influencing SHIB's Price

Shiba Inu Faces Volatility as New Meme Coin Arctic Pablo Gains Traction

Shiba Inu (SHIB) dipped 1.74% this week, trading at $0.00001298 amid broader market tremors. Despite the pullback, its $239M daily volume underscores enduring liquidity. Analysts project a 6.13% rebound to $0.00001474 by September 2025, citing whale accumulation and burn rate dynamics.

Meanwhile, Arctic Pablo's presale—boasting 66% APY—is siphoning attention from meme coin veterans. The upstart's yield mechanics challenge SHIB's dominance, particularly among risk-on retail traders. Market structure suggests bifurcation: established tokens like SHIB leverage network effects while newcomers compete with hyper-deflationary tokenomics.

How a $200 Monthly Shiba Inu Investment Could Yield $1M by 2050

Investors chasing millionaire status are eyeing Shiba Inu as a potential vehicle for outsized returns. A disciplined $200 monthly investment in the meme coin could theoretically grow to $1 million by 2050, assuming aggressive price appreciation.

The strategy hinges on dollar-cost averaging over 25 years, totaling $60,000 in principal. At current prices, this would accumulate roughly 4.61 billion SHIB tokens. For the portfolio to hit the seven-figure target, Shiba Inu's market value would need exponential growth—a speculative proposition given its volatile history.

While early adopters reaped windfalls in previous cycles, the feasibility of such returns remains contentious. Analysts caution that meme coins carry unique risks compared to blue-chip cryptocurrencies like Bitcoin or Ethereum.

MAGACOIN FINANCE Touted as Potential Successor to Shiba Inu's Meteoric Rise

MAGACOIN FINANCE has emerged as a standout in the crypto presale arena, drawing comparisons to Shiba Inu's historic 100,000% returns. Market participants are speculating whether this new token can replicate such explosive growth as the next bull cycle approaches.

The project's presale strategy targets cyclical investors seeking high-momentum opportunities. Early adopters are positioning themselves ahead of broader adoption, betting on favorable market dynamics to propel MAGACOIN into mainstream crypto discourse by 2025.

Shiba Inu's long-term prospects remain a topic of intense debate. At current levels, SHIB would require an unprecedented 7.3 million percent rally to reach $1—a scenario that would demand a $589 trillion market capitalization. While mathematically daunting, some community members maintain this target isn't impossible over an extended timeframe.

Is SHIB a good investment?

SHIB presents a high-risk, high-reward proposition:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.00001303 | 5.6% above 20-DMA |

| Bollinger Range | $0.00001172-$0.00001399 | 14% upside potential |

| MACD | Bearish crossover | But momentum weakening |

"For risk-tolerant investors," says Emma, "SHIB could offer tactical trades between Bollinger bands, but fundamentals remain speculative. Dollar-cost averaging strategies may mitigate volatility risks."

1